The ERISA consultants at the Retirement Learning Center Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings plans. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

The ERISA consultants at the Retirement Learning Center Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings plans. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

A recent call with a financial advisor from Colorado is representative of a common inquiry related to plan participant education. The advisor asked:

“I’ve heard the broad term ‘financial wellness or wellbeing’ more and more frequently in relation to retirement plan participants. What is financial wellness?”

Highlights of the Discussion

The phrase likely started with the Consumer Financial Protection Bureau (CFPB). It seems the CFPB had concluded employee financial education has not been successful in encouraging plan participants to save more for retirement. The CFPB suggests the way to fix the problem of faulty employee education is by redefining 1) what the goal of financial education is, and 2) how employees can get there, within the context of behavioral economics/finance.

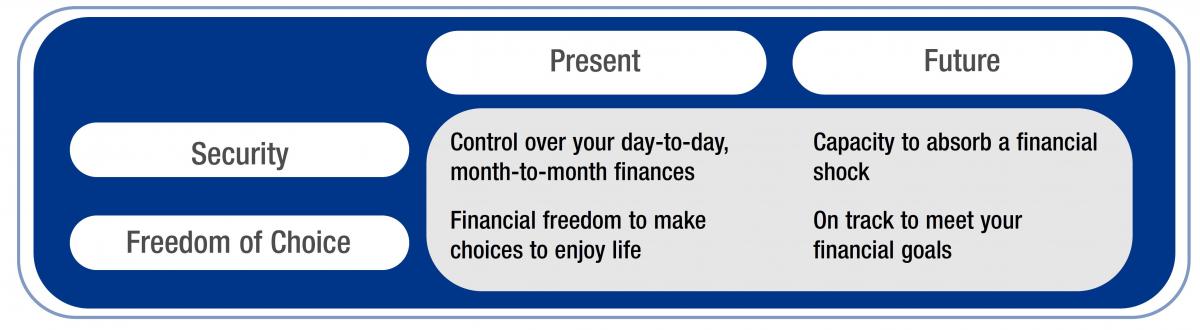

In 2015, the CFPB defined the goal of financial education as “financial wellbeing,” in its report Financial Well-being: The Goal of Finance Education. Financial well-being is a state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in his or her financial future, and is able to make choices that allow enjoyment of life. The CFPB has concluded overall financial wellness consists of four elements as illustrated below.

In the last four years, the percentage of plans that offer a comprehensive financial wellness program has grown from 16% to 23%, according to the Plan Sponsor Council of America. What are the most common employee concerns addressed by financial wellness programs?

- Getting overall spending under control (41%);

- Preparing for retirement (39%);

- Paying off debt (31%);

- Saving more for major goals (e.g., purchases, home, education) (27%);

- Better management of my investments/asset allocation (23%); and

- Better manage of healthcare expenses/saving for future healthcare expenses (12%).

The Employee Benefits Research Institute (EBRI) found an overwhelming majority of workers thought the following financial wellness programs would be either very or somewhat helpful:

- Help calculating how much to save for a secure retirement (75%);

- Help calculating how much to anticipate spending each month in retirement (72%);

- Planning for health care expenses in retirement (72%); and

- Help with comprehensive financial planning (68%).

The CFPB conducted a five-year study on consumer financial education, which culminated in a 2017 report in which it identified five principles of financial education that make the biggest difference between financial success and failure.

Principle 1: Tailor information to the specific circumstances, challenges, goals, and situational factors of the individuals served. Avoid a one-size-fits-all approach.

Principle 2: Provide timely information that is relevant and actionable to a specific situation or goal, so that information and skills are more likely to be retained.

Principle 3: Improve key financial skills.

Principle 4: Help people build qualities that strengthen and reinforce their determination to take specific steps to achieve their financial goals.

Principle 5: Help create habits and systems so that it’s easy to follow through on decisions.

The CFPB has a resource guide available on how to launch a workplace financial wellness program by following eight basic steps:

1. Focus on your human resources (HR) strategy;

2. Identify possible internal challenges;

3. Understand your workforce’s unique needs;

4. Decide which financial topics to highlight;

5. Leverage existing employee benefits;

6. Expand your employee offerings with more financial education resources;

7. Use existing or new channels and opportunities to deliver resources; and

8. Establish metrics for success for your financial wellness program.

Conclusion

Financial wellness is more than educating plan participants. It is taking financial education to the next level to help plan participants fully meet current and ongoing financial obligations, feel secure in their financial future, and be able to make choices that allow enjoyment of life.

Any information provided is for informational purposes only. It cannot be used for the purposes of avoiding penalties and taxes. Consumers should consult with their tax advisor or attorney regarding their specific situation.

©2019, Retirement Learning Center, LLC. Used with permission.