Most people remain hesitant to invest in cryptocurrency in their DC plans, but a recent survey finds that there’s a small “crypto-curious” contingent.

Most people remain hesitant to invest in cryptocurrency in their DC plans, but a recent survey finds that there’s a small “crypto-curious” contingent.

With the increased attention of cryptocurrency, Stan Treger, behavioral scientist at Morningstar, notes that analysts at the firm began to wonder if investors would welcome this asset into their retirement portfolios. As such, they posed this question as part of a larger, nationally representative survey of about 1,400 people conducted in May 2021.

The firm asked survey participants to rank a set of 16 potential retirement plan features in order of most to least preferred, including the option to invest in cryptocurrencies, the availability of professionally managed options, auto escalation and investment advice. Participants largely ranked cryptocurrency last as a desired feature in a retirement fund—the most common ranking for cryptocurrency was 16 out of 16, with 24% of respondents ranking it last. There was, however, a small contingent (3%) that ranked it first. Morningstar notes that the mean and median ranks for cryptocurrency were 11.08 and 12, respectively, out of 16.

Young Investors

While investors for the most part seem wary of adding such funds into their retirement portfolios, young investors are the one group that tends to be more interested in cryptocurrency. Morningstar’s data appears to reflect this notion, with age accounting for about 4.8% of the variance in the rankings of cryptocurrency. The older the participants, the less important they found cryptocurrency, Treger notes.

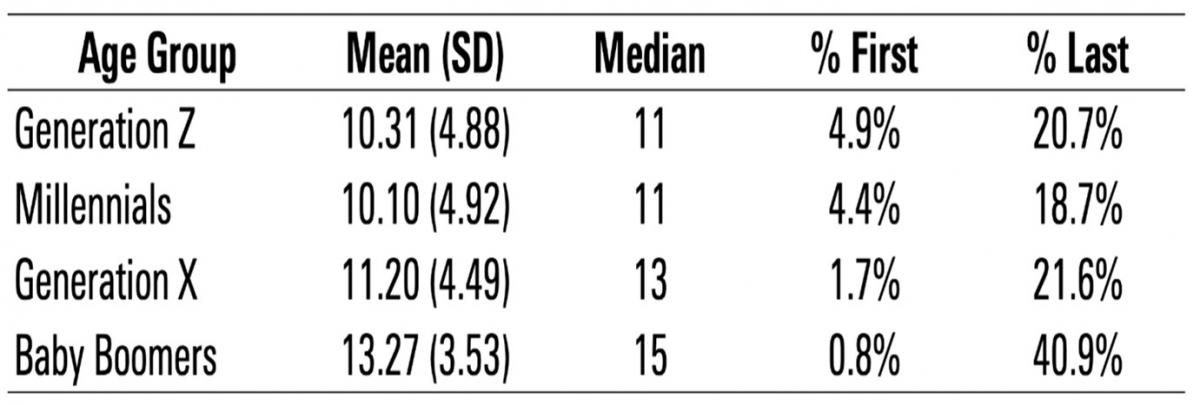

Morningstar’s chart below breaks down the desirability of cryptocurrency by generation, displaying the average and median ranks by age group, as well as the percentage of the age group that selected cryptocurrency to be the most important and the least important feature of a retirement plan. The “% First” heading denotes the percentage of the age group that ranked cryptocurrency as its most desired feature, while the “% Last” indicates the percentage of the age group that ranked cryptocurrency as its least-desired feature.

As indicated, younger adults—including Gen Z and Millennials—were approximately five times as likely to prefer cryptocurrency in their retirement plan as the oldest generation. In contrast, Baby Boomers were approximately twice as likely as any other generation to rank cryptocurrency last.

Still, although younger investors appear to find cryptocurrency more appealing than older investors do, there is a general hesitancy to add it to their retirement portfolios. “It may be five times as likely to be interested in cryptocurrency, but that interested group still adds up to less than 5% of the broader population of younger investors,” Treger emphasizes. “Thus, while advisors might find it worthwhile to gauge clients’ interest in cryptocurrency, particularly Millennial and Generation Z clients, it shouldn’t be a primary factor in decision-making,” he adds. “People still tend to desire traditionally attractive features such as good employer matches and the availability of professional advice.”

Morningstar’s findings in relation to participant views appear to be fairly consistent with a recent NAPA Net reader poll that asked what readers thought about Bitcoin as an investment option, where there was quite a bit of skepticism, but also some interest.

And what about the rankings of those other 15 features? Those findings will appear in a future update, Morningstar notes.