The ERISA consultants at the Retirement Learning Center Resource regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings plans. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

The ERISA consultants at the Retirement Learning Center Resource regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings plans. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

A recent call with an advisor in Columbus, OH is representative of a common question involving IRA contributions. The advisor asked:

A colleague of mine said a 60-year-old couple who is a client of his just made a $28,000 IRA contribution. Is this some new kind of plan? I thought the maximum contribution was $6,000, with a potential additional $1,000 catch-up contribution for someone age 50 and over?

Highlights of Recommendations

- A $28,000 IRA contribution for the couple is possible, courtesy of a combination of several IRS rules covering: (1) carry-back and current year contributions; (2) spousal contributions; and (3) catch-up contributions.

- From Jan. 1, 2021 to May 17, 2021[1], it is potentially possible for a traditional or Roth IRA owner age 50 and over to make a $14,000 contribution: $7,000 as a 2020 carry-back contribution and $7,000 as a 2021 current-year contribution. That means a married couple filing a joint tax return could potentially make a $28,000 IRA contribution, with $14,000 going to each spouse’s respective IRA.

- When making the contributions it is important to clearly designate to the IRA administrator that a portion is a carry-back contribution for 2020 and a portion is a 2021 current-year contribution in order to avoid having the full amount treated as a current-year contribution and, subsequently, an excess contribution for 2021.

- Such a large combined contribution would only be possible if:

- the couple had not previously made a 2020 contribution to a traditional or Roth IRA;

- each spouse was age 50 or older as of 12/31/2020;

- the couple has earned income for 2020 and 2021 to support the contributions; and

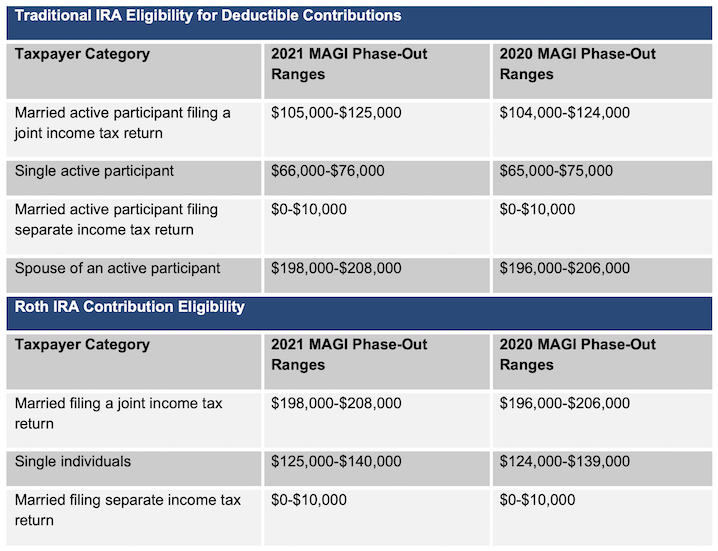

- for a Roth IRA contribution, the couple’s income is under the modified adjusted gross income (MAGI) limits for Roth IRA contribution eligibility (see below).

- Whether the traditional IRA contributions would be tax deductible depends upon “coverage” of either spouse by a workplace retirement plan[2] and the couple’s MAGI.

- Please see the applicable MAGI ranges in the following chart.

Conclusion

The deadline for making 2020 traditional or Roth IRA contributions is May 17, 2021. That means there is a window of opportunity that allows eligible investors to double up on IRA contributions (for 2020 and for 2021) to the tune of $28,000.

Any information provided is for informational purposes only. It cannot be used for the purposes of avoiding penalties and taxes. Consumers should consult with their tax advisor or attorney regarding their specific situation.

©2021, Retirement Learning Center, LLC. Used with permission.

[1] Usually, April 15, but the IRS extended the 2020 tax filing deadline to May 17, 2021.