The ERISA consultants at the Retirement Learning Center Resource regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings plans.

A recent call with a financial advisor from Massachusetts is representative of a common inquiry related to the maximum annual limit on employee salary deferrals. The advisor asked:

“One of my clients participates in a 401(k) plan (her own “solo (k)”), plus a 403(b) plan and a 457(b) plan (through the public school system). Her accountant is telling her that she, potentially, could contribute twice the $18,500 deferral limit for 2018. How can that be so?”

Highlights of Discussion

First off, kudos to your client for working with you and a tax advisor in order to determine what amounts she can contribute to her employer-sponsored retirement plans, as this is an important tax question based on her personal situation that is best answered with the help of professionals. Generally speaking, it may be possible for her to contribute more than one would expect given the plan types she has and based on existing plan contributions rules, which are covered below.

For 2018, 457(b) contributions (consisting of employee salary deferrals and/or employer contributions combined) cannot exceed $18,500, plus catch-up contribution amounts if eligible [Treas. Reg. §1.457-5]. Since 2002, contributions to 457(b) plans no longer reduce the amount of deferrals to other salary deferral plans, such as 401(k) plans. A participant’s 457(b) contributions need only be combined with contributions to other 457(b) plans when applying the annual contribution limit. Therefore, contributions to a 457(b) plan are not aggregated with deferrals an individual makes to other types of plans.

In contrast, the application of the maximum annual deferral limit under Internal Revenue Code (IRC) § 402(g) (the “402(g) limit”) for an individual who participates in both a 401(k) and a 403(b) plan requires the individual to aggregate deferrals between the two plans [Treas. Reg. §1.402(g)-1(b)]. Consequently, an individual who participates in both a 457(b) plan and one or more other deferral-type plans, such as a 403(b), 401(k), salary reduction simplified employee pension plan, or savings incentive match plan for employees has two separate annual deferral limits. Let’s look at an example.

Example #1

For 2018, 32-year-old Erika has an individual 401(k) plan for her business as a self-employed tutor. She is also on the faculty at the local state university, and participates in its 457(b) and 403(b) plans. Assuming adequate levels of compensation, Erika can defer up to $18,500 between her 401(k) plan and her 403(b) plan, plus another $18,500 to her 457(b) plan.

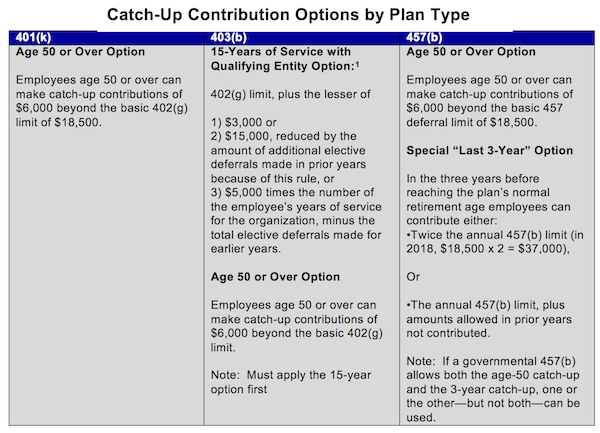

Also, keep in mind the various special catch-up contribution options depending on the type of plan outlined in the following table.

Another consideration when an individual participates in more than one plan is the annual additions limit under IRC § 415(c),² which typically limits plan contributions (employer plus employee contributions for the person) for a limitation year³ made on behalf of an individual to all plans maintained by the same employer. However, contributions to 457(b) plans are not included in a person’s annual additions (see Treas. Reg. §1.415(c)-1(a)(2).

Generally, the IRS considers 403(b) participants to have exclusive control over their own 403(b) plans [Treas. Reg. §1.415(f)-1(f)(1)]. Therefore, in many cases, contributions to a 403(b) plan are not aggregated with contributions to any other defined contribution plan of the individual (meaning two 415 annual additions limits). An exception to this rule, however, occurs when the participant is deemed to control the employer sponsoring the defined contribution plan in which he or she participates. In such case, a participant must aggregate his or her 403(b) contributions with contributions to any other defined contribution plans that he or she may control [see IRC § 415(k)(4)]. Regarding the treatment of catch-up contributions, the “Age 50 or Over” catch-up contributions [see Treas. Reg. §1.415(c)-1(b)(2)(ii)(B)] are not included as annual additions, regardless of plan type, whereas the 403(b) “15-Years of Service” catch-up contributions are included as annual additions (IRS 403(b) Fix-It Guide).

Example #2

Adam is employed by an IRC 501(c)(3) organization that contributes to a 403(b) plan on his behalf. Adam is also a participant in the organization's defined contribution plan. Since Adam is deemed to control his own 403(b) plan, he is not required to aggregate contributions under the qualified defined contribution plan with those made under the 403(b) plan for purposes of the 415 annual additions test.

Example #3

The facts are the same as in Example #2, except that Adam is also a participant in a defined contribution plan of a corporation in which he is more than a 50% owner. The defined contribution plan of Adam’s corporation must be combined with his 403(b) plan for purposes of applying the limit under IRC 415(c) because Adam controls his corporation and is deemed to control his 403(b) plan.

Example #4

Dr. U.R. Well is employed by a nonprofit hospital that provides him with a 403(b) annuity contract. Doctor Well also maintains a private practice as a shareholder owning more than 50% of a professional corporation. Any qualified defined contribution plan of the professional corporation must be aggregated with the IRC 403(b) annuity contract for purposes of applying the 415 annual additions limit.

For more examples, please see the IRS’ Issue Snapshot - 403(b) Plan – Plan Aggregation.

Conclusion

Sometimes individuals who are lucky enough to participate in multiple employer-sponsored retirement plan types are puzzled by what their maximum contribution limits are. This is especially true when a person participates in a 401(k), 403(b) and 457(b) plan. That is why it is important to work with a financial and/or tax professional to help determine the optimal amount based on the participant’s unique situation.

Footnotes

1. A public school system, hospital, home health service agency, health and welfare service agency, church, or convention or association of churches (or associated organization).

2. For 2018, the limit is 100% of compensation up to $55,000 (or $61,000 for those > age 50).

3. Generally, the calendar year, unless the plan specifies otherwise.

Any information provided is for informational purposes only. It cannot be used for the purposes of avoiding penalties and taxes. Consumers should consult with their tax advisor or attorney regarding their specific situation.

©2018, Retirement Learning Center, LLC. Used with permission.